What is a Triple Net Lease?

If you are a real estate veteran, you’ve likely heard of a triple net lease (also called an NNN lease) before. However, for newcomers to the field, you might be feeling overwhelmed by all of the technical terminology that’s associated with commercial real estate – so let’s build a better understanding together, starting with one of the most important terms in commercial real estate.

A triple net lease is a type of lease agreement in which the tenant pays not only rent and utilities but also all other property-related expenses, including real estate taxes, building insurance, and maintenance. Gaining a full understanding of NNN leases is crucial for both landlords and tenants in retail, industrial, and office sectors.

Today, we’ll dive deeper into what triple net leases are, how they work, how they compare to other types of commercial leases, their numerous advantages, and more.

What is a Triple Net Lease and How Do They Work?

A triple net lease is an agreement between a tenant and a landlord that involves the tenant paying base rent and utilities as well as additional expenses such as property taxes, insurance, and maintenance. This type of lease is typically used in commercial real estate investing and comes with advantages to both the landlord and the tenant. Let’s break down these three main expenses the tenant is responsible for in a bit more detail:

- Property taxes: A source of revenue for local governments, these taxes vary by state. The Tax Foundation reports that property taxes as a percent of property value range from 0.26% in Hawaii to 2.08% in New Jersey.

- Insurance: There are different types of property insurance that NNN lease tenants may choose. Holding insurance insulates both the tenant and landlord from financial loss if damage to the property occurs.

- Maintenance: While other types of net leases (single and double) leave maintenance responsibilities with the landlord, NNN leases pass this onto the tenant. Maintenance costs could include routine things like pressure washing a parking lot or having the property inspected, or more “out-of-the-blue” things like repairing a sudden burst pipe.

Triple net leases are commonly used in industries such as restaurants, retail, gas stations, pharmacies, and industrial properties. These leases are typically long-term agreements, ranging from 3 to 50 years with most falling in the realm of 10 to 30 years. Other terms to consider in your NNN lease include rent and escalator clauses.

As for rent, what base rent will the tenant pay? Base rent for a NNN lease is usually lower than it would be for other commercial real estate leases, because the tenant is also responsible for taxes, insurance, and maintenance. Some triple net leases include what is called “escalator clauses,” which are rent bumps typically between 5% to 10% every 5-10 years to account for inflation over the time period of a long-term lease.

Advantages of Triple Net Leases

Triple net leases are among the most popular in the world of commercial real estate, and it’s no wonder why. There are many advantages of triple net leases for both landlords and tenants. Plus, Globest reports that cap rates are rising in 2024, up 100 basis points year over year to 6.25%, meaning that savvy investors can get even more bang for their buck.

Triple Net Lease Advantages for Landlords

For landlords, a triple net lease provides a steady and predictable income stream. Additionally, passing the responsibilities of maintenance to the tenant reduces the time-consuming nature of property management. Plus, the long-lasting lease terms of NNN agreements mean that the landlord gets to build long-term relationships with tenants. While the base rent of an NNN property might be lower, landlords typically appreciate handing off additional expenses to their tenants, which makes overall property management much easier.

Triple Net Lease Advantages for Tenants

Although they are responsible for more expenses under a triple net lease, tenants benefit from lower base rent costs. This gives them greater control over their expenses and allows them to take property management into their own hands, meaning they can customize the property to their liking. They can also typically choose their own insurance provider.

When considering triple net vs gross leases or other types of leasing agreements, you will see that triple net leases are much more common in commercial real estate whereas gross leases are more common in residential leasing agreements.

Let’s dive a bit deeper into the similarities and differences in lease types…

How Triple Net Lease Compare to Other Lease Types

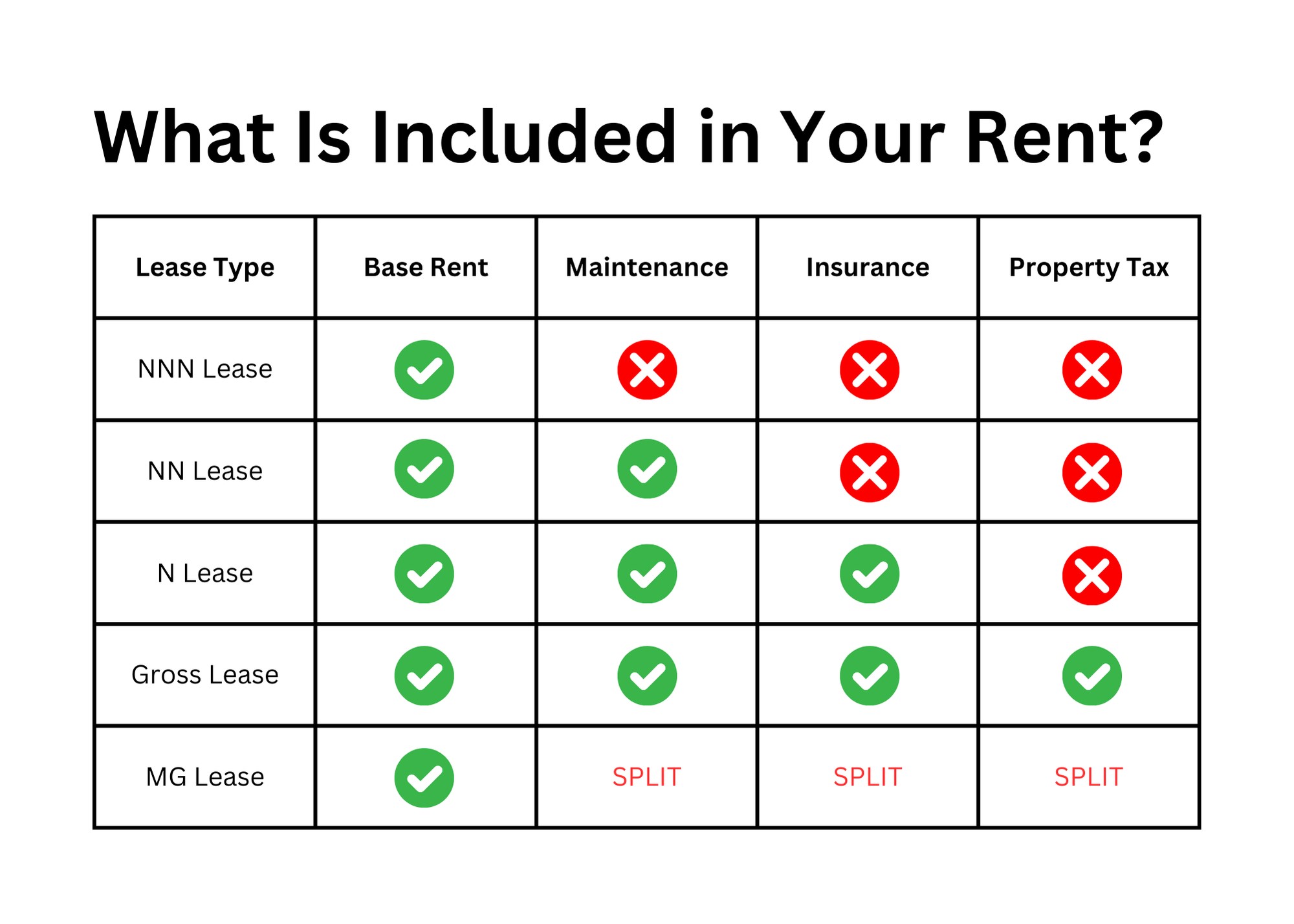

Triple net leases are markedly different from other common lease types, such as gross leases, modified gross leases, and full-service leases.

Gross Leases: With a gross lease, a tenant pays a set amount for rent. Apart from that, the landlord is responsible for all expenses, including insurance, maintenance, and property taxes. You’ll often find a triple net lease described as the opposite of a gross lease. Learn more about triple net vs gross leases here.

Modified Gross Leases: With a modified gross lease, often abbreviated as simply MG, the tenant and landlord share expenses under the three categories previously outlined (property taxes, insurance, and common area maintenance). MG leases can be more flexible than NNN leases, but can also lead to more unpredictable costs, making it harder to budget effectively.

Full-Service Leases: Somewhat similar to gross leases, full-service leases include every service in one base monthly or annual rent price. This may include property management, janitorial services, taxes, and insurance – and will likely go above and beyond what is included in a gross lease. This lease is common in multi-tenant office buildings, for instance. NNN leases are more likely to be used in large, single tenant spaces as they offer more flexibility for tenants.

See a bird’s-eye view of triple net leases as compared to other types of leases here:

Example of a Triple Net Lease in Action

Let’s break down how a triple net lease might look for a creditworthy tenant like CVS, for example. As a triple-net lease investor, you will expect the base rent as your payment. However, the tenant will also want to budget for expected operating expenses, property taxes, and insurance to find how much they will actually spend each month.

Here’s an example, assuming the net lease purchase price is $3.5 million:

| Line Item | Annual Cost |

|---|---|

| Base Rent | $200,000 |

| Operating Expenses/Maintenance | $200,000 |

| Property Taxes | $30,000 |

| Insurance | $20,000 |

| Annual Cost to Tenant | $450,000 |

| Monthly Cost to Tenant | $37,500 |

In this example, our tenant is paying an average of $37,500 per month for rent and all of the expenses involved in running a commercial property.

And for the landlord, with a purchase price of $3.5 million and $200,000 in annual base rent, the property offers a cap rate of 5.7%, giving them a predictable return and a hands-off investment.

When to Choose a Triple Net Lease

Choosing a triple net lease is a big decision – but for both landlords and tenants, it can come with many benefits. For landlords who are looking to be passive investors in commercial real estate, building long-term relationships with their tenants, and invest in stable markets, triple net leases can be a huge boon to their portfolios. Tenants can also benefit from the flexibility in property customization and stable operating costs that come with an NNN lease.

Is an NNN lease right for you? The first step is often finding an ideal property. The main risk with single-tenant net lease (STNL) properties is a vacancy – so ensure the property you are investing in meets the standard criteria of desirable, creditworthy tenants. Look at in-demand triple net lease properties near you today.

Get Started on Your Triple Net Property Journey Today

For landlords who are seeking stability and autonomy, NNN leases are a low-risk, high-reward way to get your foot in the door of the highly lucrative commercial real estate market. Understanding the different lease structures available on today’s market is the best way to start so that you can ensure you’re choosing a property that meets your investment goals.

Get started now by exploring listings and learning more about the highest-quality triple net properties near you – or explore tenant profiles as you look at local options. What are you waiting for?