What Does Triple-Net Mean in Commercial Real Estate?

"Triple-net" is a commonly used term in commercial real estate that refers to a lease structure where tenants are responsible for paying the net costs associated with the property in addition to the base rent.

This lease structure often benefits both landlords and tenants. Landlords are relieved of the day-to-day operating expenses and administrative tasks associated with property ownership, while tenants gain more control over the property and have the ability to customize the space to suit their needs. Triple-net leases are often favored by investors seeking a steady income stream and minimal management responsibilities.

In this article, we will explore the benefits of triple-net leases as well as common tenants, landlord and lessee responsibilities, and more. Commercial real estate investors looking to gain a better understanding of the world of net leases will benefit from this deep dive into the topic.

What is a Triple-Net Lease?

A triple-net lease is a type of commercial real estate lease agreement in which the tenant assumes the responsibility for paying the majority, if not all, of the property's operating expenses in addition to the base rent. The "triple" in triple-net represents three main expenses: property taxes, insurance, and maintenance.

Under a triple-net lease, the tenant assumes the financial burden of these additional costs, allowing the property owner to transfer some of the financial responsibilities typically shouldered by the landlord. The tenant pays their share of property taxes, which are determined by the assessed value of the property.

Insurance costs, including coverage for liability and property damage, are also passed on to the tenant. Additionally, the tenant is responsible for the costs of ongoing property maintenance, such as repairs, landscaping, and utilities.

What Are the Landlord’s Responsibilities in a Triple-Net Lease?

In a triple-net lease agreement, the landlord's responsibilities are typically limited to the ownership and management of the property itself, as the tenant assumes the majority of the operating expenses. The specific responsibilities of the landlord can vary depending on the terms negotiated in the lease but generally include:

Property ownership:the landlord retains ownership of the property and is responsible for maintaining legal ownership rights.

Property maintenance:the landlord may still have certain obligations related to major structural repairs or issues that are beyond the tenant's control.

Lease administration:the landlord is responsible for managing the lease agreement, including collecting the base rent and additional charges from the tenant, enforcing lease terms, and addressing any lease-related disputes or issues that may arise.

Capital expenditures:the landlord may be responsible for major capital expenditures such as roof replacements or HVAC system upgrades.

What Are the Benefits of a Triple-Net Lease?

A triple-net lease can offer a mutually beneficial arrangement, providing landlords with stable income and reduced management responsibilities, while tenants gain customization options and long-term stability.

Stable Income for Landlords

One of the primary advantages of a triple-net lease for landlords is the predictable and stable income stream it provides. By shifting the responsibility for operating expenses to the tenant, landlords can rely on consistent rental payments without the financial burden of property taxes, insurance, and maintenance costs. This stability makes triple-net leases attractive to long-term investors seeking reliable cash flow.

Reduced Management Responsibilities

With a triple-net lease, the tenant assumes the majority of the property's operational and maintenance obligations. This relieves the landlord of day-to-day management tasks, such as handling repairs, managing utility expenses, and ensuring compliance with local regulations. Landlords can focus more on property ownership, asset appreciation, and strategic decisions rather than the operational aspects.

Long-Term Stability

Triple-net leases are often structured with longer lease terms, providing stability for both landlords and tenants. For landlords, longer leases reduce the risk of vacancies and turnover, ensuring consistent rental income over an extended period. Tenants benefit from the stability as well, as they can establish a long-term presence and avoid the costs and disruptions associated with relocating their business.

Example of a Triple-Net Lease Property

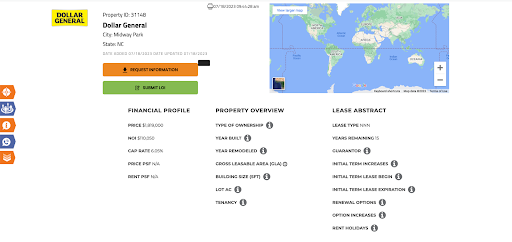

If you’re considering investing in a triple-net lease, you should know how the numbers will work out on your new investment property. For this example, we’re going to go over this Dollar General property located in Midway Park, NC.

The purchase price is $1,819,000, while the NOI is $110,050. Because this is a NNN property, that means the landlord is not responsible for taxes, insurance, or maintenance. This leaves the property with a cap rate of 6.05%.

We get to this number by dividing the purchase price ($1,819,000) by the NOI ($110,050), which leaves us with 6.05%. In other words, this stable-income investment will be fully paid for in just 16.5 years and is pure profit after that period of time.

How is a Triple-Net Lease Different from Single and Double-Net Leases?

Triple-net leases, single-net leases, and double-net leases are different types of commercial real estate lease structures that vary in terms of the expenses the tenant is responsible for. Here's a breakdown of the key differences.

| What does the lessee pay? | ||||

| Rent | Property Taxes | Insurance | Maintenance | |

| Single-Net Lease | ||||

| Double-Net Lease | ||||

| Triple-Net Lease | ||||

The key distinction between these lease types lies in the allocation of expenses beyond the base rent. While a triple-net lease transfers the majority of expenses to the tenant, a double-net lease involves the tenant paying property taxes and insurance, and a single-net lease only requires the tenant to pay property taxes.

What Are Some Common Triple-Net Lease Tenants?

Triple-net leases are commonly utilized by a variety of commercial tenants across different industries, including:

Retail chains:tenants of large retail chains, such as fast-food restaurants, convenience stores, pharmacies, and national retailers, benefit from the flexibility and control provided by a triple-net lease. These tenants might include companies like Taco Bell and CVS.

Banks and financial institutions:banks and financial institutions frequently opt for triple-net leases, allowing them to establish a long-term presence in desirable areas while offloading the responsibility of property taxes, insurance, and maintenance to the tenant. Candidates in this space include Chase Bank and others.

Healthcare providers:triple-net leases allow medical offices, clinics, and healthcare facilities to focus on providing quality care rather than property management. Tenants in this space include names like Aspen Dental, Fresenius Kidney Care, and DaVita.

Industrial and manufacturing companies: industrial and manufacturing tenants benefit from the control over their operations and the ability to customize the space to suit their specific operational needs.

What’s the Appeal of Investing in a Triple-Net Lease Property?

Investing in a triple-net lease property holds several appealing advantages for investors, making it a popular choice in the commercial real estate market.

Stable Income Stream

One of the primary appeals of investing in a triple-net lease property is the predictable and stable income it generates. With tenants responsible for paying property taxes, insurance premiums, and maintenance costs in addition to the base rent, investors can rely on a steady cash flow.

Long-Term Lease Agreements

Triple-net leases often involve long-term lease agreements, providing investors with greater stability and reduced vacancy risks. Longer lease terms result in lower turnover rates, ensuring a consistent, reliable income stream over an extended period.

Lower Operational Risks

By shifting operating expenses to tenants, investors can mitigate some of the financial risks associated with property ownership. Property taxes, insurance costs, and maintenance expenses become the responsibility of the tenant, reducing the impact of potential increases in these costs on the investor's bottom line.

Diversification

Triple-net lease investments offer an opportunity for diversification within a real estate portfolio. Investors can choose properties across different sectors, such as retail, healthcare, or industrial, and potentially spread their risk across various tenants and industries.

A triple-net lease is a type of commercial real estate agreement where the tenant assumes responsibility for paying not only the rent but also all operating expenses, property taxes, and insurance. This arrangement offers significant benefits to investors, like providing a stable and predictable income stream, as the tenant is responsible for most of the property's costs.

Triple-net leases also reduce the landlord's operational burden, as the tenant assumes maintenance and repair obligations. Finally, it minimizes the financial risks for investors by transferring property-related expenses to the tenant. These advantages make triple-net leases an attractive investment option for those seeking steady income and reduced management responsibilities.