1031 Exchange Rules for Investment Properties

If you currently own an investment property and are thinking about selling it, you may just want to consider a 1031 tax-deferred exchange. It’s a real estate investment strategy that allows you to get more bang for your buck in the long term and continue to grow your real estate investment portfolio.

As with any real estate investment, there are many legal details you need to sort through and understand before making any serious moves with your real estate portfolio. Here, we’ll cover the basics of what a 1031 exchange is, the criteria to qualify, and the 1031 exchange rules you need to be aware of to perform one.

This will help set you on the right track for your investment planning.

Let’s get started with the basics.

The Basics of a 1031 Exchange

Through section 1031 of the Internal Revenue Code (IRC), a person can delay paying income tax for cash they’ve earned from the sale of an investment property by ‘swapping’ their real estate property for another. Typically, this is simply referred to as a 1031, 1031 exchange, and, in some cases, a like-kind exchange or Starker exchange.

Of course, this isn’t as simple as swapping the property deeds, as nice as that would be. A 1031 exchange involves going through the process of selling the property you currently own and a third party (this must be a qualified intermediary) holding the earnings from the sale to pay for another property that meets set criteria within a strict time frame.

Who or What is a Qualified Intermediary?

A qualified intermediary, also known as a QI, is a person or company that facilitates 1031 exchanges by holding the earnings of a property sale for the owner until the earnings can be transferred to the seller of the replacement property.

They’re an essential part of a 1031 exchange because you can not hold the cash at any point in the exchange process. Otherwise, the exchange would no longer be taxed deferred, and you’d be taxed on the sales earnings.

With all this in mind, and with wanting to protect your earnings through a tax-deferred exchange, you’re likely wondering who you can use as a qualified intermediary. You can select who it is, but you have to do so carefully, as it can not be someone you’re related to or work with (including a real estate agent or lawyer you may be working with for your portfolio); in fact, it can’t even be your own bank.

1031 Exchange Time Limits

What is the strict time frame you must follow? You have until your taxes are due or up to 180 days from the date your property is transferred to the buyer or the date recorded on the deed (whichever is earlier). If you’re selling more than one property, this timeline is based on the transfer date of the first property.

It’s also important to be aware that you must have a designated replacement property shared with the third party holding your earnings within the first 45 days of this exchange window. (This time limit is often referred to as the 45-day rule.)

If you’re wondering if it’s possible to reverse this process (by purchasing the replacement property before selling your current one), this is called a reverse exchange. The time limits (and the 1031 exchange criteria we’ll be diving into next) remain the same, with the start date being the date the ownership is transferred to you.

1031 Exchange Criteria

Let’s take a closer look at the 1031 exchange criteria we mentioned earlier, as it's essential to ensure you qualify for the tax deferral.

The properties exchanged must be of like-kind, meaning the properties being exchanged must be similar to one another. However, the IRC makes it clear that the quality of the two properties can be different.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

However, 1031 Exchanges can not be made with a principal residence property, meaning the exchanged properties must be a business or investment property. Thankfully, they don’t need to be the same business or investment type, as there’s a lot of flexibility in what the Internal Revenue Code considers like-kind.

1031 Exchange Rules for Multiple Replacement Properties

What if you want to replace your current investment with more than one property? This is more than possible, and a few rules have been put in place to guide you through this process. As long as you follow these 1031 exchange rules, you can exchange your investment property for multiple properties:

The Three-Property Rule

To meet the 45-day rule, you can identify three different properties to use for the exchange. You don’t have to buy all three, but you should be able to list the properties to your QI in a formal capacity.

The 200% Rule

Alternatively, you can use the 200% rule, which allows you to identify any number of properties as long as the total value of all replacement properties does not exceed 200% of the value of the sold property. All the identified properties are not required to be purchased for the exchange, only the amount needed to meet the value requirement.

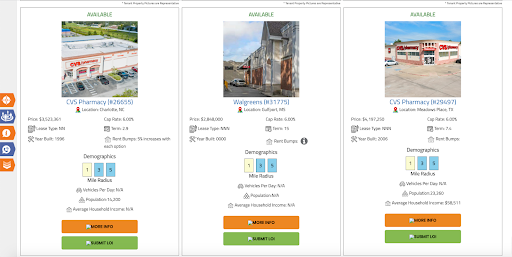

For example, if you’d like to do a 1031 exchange with a CVS NNN property that sells for $5,500,000, you could list as many properties as you’d like as long as you do not exceed a collective total of $11,000,000.

Via the NetLeaseFinder NNN Property Deal Finder

The 95% Rule

Lastly, you may also choose to follow the 95% rule, which also allows you to list or identify any number of replacement properties with no limit to the total cost. The key aspect of this rule is that by the end of the 180 days, a total of 95% of the identified properties need to be purchased, or the entire exchange is invalid.

The 1031 Exchange Boot Explained

The term boot is used in discussing the taxable earnings of a 1031 exchange. It refers to the amount of money you receive or additional property you add if the replacement property is less than the original property in the exchange.

This is a significant consideration because it will impact how much of your investment can be tax deferred compared to how much you will pay in capital gains taxes.

The most common sources of boot include the following:

Cash Boot

This will usually be in the form of net cash, made up of the difference between cash received from the sale of your sold property and amount paid to acquire the replacement property(ies).

Net cash received can result when you’re trading down in the exchange — meaning the sale price of the replacement property(ies) is less than that of the sold property.

Mortgage or Debt Reduction Boot

This occurs when your mortgage on the replacement property is less than the debt on the sold property. As with cash boot, debt reduction boot can occur when a taxpayer trades down in the exchange and creates a taxable income from the exchange.

Sale Earnings Used For Non-Qualified Expenses

You can not include costs like services for closing the exchange deal in the overall cost of the exchange; this means that all of these costs will become a cash boot (if they’ve been inaccurately included in the exchange costs).

Borrowing Too Much & Loan Acquisition Costs

If you borrow money or take on fees to get a loan to help fund purchasing your exchange property, it can all impact your taxable income.

If you borrow more money than you need, the cash you’ve borrowed or received through a loan will be the first to pay for your new exchange property. This means you’ll end up with the earnings from the property sale.

It’s also not uncommon for those in the process of a 1031 exchange to think the fees for obtaining a loan can come from the sales, but the sales earnings can’t be used for this (instead, you have to fund loan acquisition from your personal funds).

How to Avoid a 1031 Exchange Boot

To avoid a taxable income from a 1031 exchange, avoiding the exchange boot from any of the above causes is key. You can do this by ensuring that the new property is the same total as the old one and being aware of the mortgage for the replacement property. Another option is to invest all cash that you might earn from the exchange into a new property.

1031 Exchanges at a Glance

A 1031 exchange gives you, as a property investor, more options to have your property investment(s) work for you. Of course, as with any tax deferring or tax break processes, there are key rules and guidelines you need to follow.

In this article, we’ve outlined the basic criteria you should know if you’re contemplating this property exchange. Here are a few of the key takeaways:

- Through section 1031 of the Internal Revenue Code, you can exchange one investment property for another (or multiple properties) to defer tax payments.

- You have 45 days from the date you transfer your property to the new owner to identify replacement properties.

- For this, there are three rules to know: the rule of three properties, the 200% rule, and the 95% rule.

- You have 180 days from the date you transfer your property to the new owner to obtain a replacement property.

- If your replacement property is less than your original property, you will end up with a taxable 1031 exchange boot.

- With a 1031 exchange, tax payments are deferred, but they’re not tax-free. This means that down the road, you will have to pay taxes on earnings from your investment property.

If you have questions, or are feeling ready to start exploring a 1031 exchange for your property, get in touch with our knowledgeable and qualified team.