NNN Properties For Sale in Tennessee

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

| Triple Net Properties in Tennessee Overview | |

| State population | 7.126 million |

| Number of business entities | 486,000+ |

| Average NNN lease property cost | $1M - $2M |

| Average cap rate | 5.9% - 7.4% |

| Corporate income tax rate | 6.5% |

| Personal income tax rate | 0% |

| Capital gains tax rate | 0% |

Tennessee presents a hotbed of opportunity for commercial real estate investors. The Volunteer State is experiencing a business boom, with a record number of companies registering to do business there – a whopping 37.5% increase year over year! Plus, Tennessee does not levy a personal income tax or capital gains tax, rendering it an overall favorable tax environment.

Common NNN Lease Tenants in Tennessee

Common NNN properties for sale in Tennessee include tenants that represent a sample of the top NNN lease investments available in the entire nation. For instance, you’ll see tenants in categories like…

- Fast food and QSR chains (Starbucks, Chick-fil-A, Burger King, McDonald’s, etc.))

- Pharmacies (Walgreens, CVS, etc.)

- Gas stations (7-Eleven, Wawa, etc.)

- Grocery stores (Publix, Kroger, Winn-Dixie, etc.)

- Big-box retail stores (Walmart, Target, Dollar General, etc.)

Great Cities in Tennessee for an NNN Property

Memphis and Nashville are the two most populous cities in Tennessee, with over half a million people each. However, their populations have remained largely steady over the past couple of years. A growing population means more customers for your NNN lease tenants, and therefore a more desirable and profitable environment. With that said, they’re still great options for an NNN property.

Here are some of Tennessee’s top cities for NNN properties, including a few other less populous options with high rates of population growth…

Nashville, TN

As you look at investing in commercial real estate in Tennessee, you cannot pass over Nashville. The state’s capital city is home to over 600,000 people and has a major tourism draw as well. There are many big-box retailers here as well as smaller tenants for modest NNN properties.

Memphis, TN

Memphis is Tennessee's second-largest city and boasts a large population of over 613,000 residents. The surrounding area also has a rich suburban community that adds to the average annual income of the area and makes this a perfect spot for high-end NNN tenants.

Knoxville, TN

Located in eastern Tennessee, Knoxville offers a beautiful downtown set on the Tennessee River and a charming historic district. It is also well-known for its upscale demographics, high standard of living, and outdoorsy culture. The population of Knoxville is about 200,000 people and is growing at a rate of about 1.1% every year.

Chattanooga, TN

The population of Chattanooga is over 188,000 and is growing by about 1% every year. The city is located in southeastern Tennessee among the foothills of the Appalachian mountains and offers a beautiful natural environment coupled with a robust local economy and commercial centers. An affordable cost of living attracts many to this city, just above the Georgia border.

Powell, TN

The city of Powell, Tennessee has about 16,000 residents – but its population is booming, exhibiting a growth rate of 7.69% year over year. The area is considered one of Knoxville’s northern suburbs. If you are looking for a more affordable, up-and-coming location to gain a foothold in Tennessee's NNN real estate game, Powell is an ideal location.

What Types of Net Leases Are Common in Tennessee?

In Tennessee, single-tenant NNN leases are the most common type of net lease used in commercial real estate. You might also see double net leases, or NN leases, for certain industrial or office spaces. However, triple net properties are particularly popular in Tennessee due to the reduced risk they offer for landlords.

NNN leases offer landlords the least amount of responsibility when compared with other types of net leases. Within the category of net leases, there are three tiers: single net lease (N), double net lease (NN), and triple net lease (NNN). As the levels increase, commercial real estate investors can pass additional expenses onto their tenants.

Under a single net lease, the tenant pays for property taxes in addition to base rent. A double net lease renders the tenant responsible for base rent, property taxes, and insurance. With a triple net, or NNN, lease the tenant pays for base rent, property taxes, insurance, and maintenance. This makes NNN leases ideal for landlords seeking passive, predictable income.

How to Evaluate a Net Lease for Sale in Tennessee

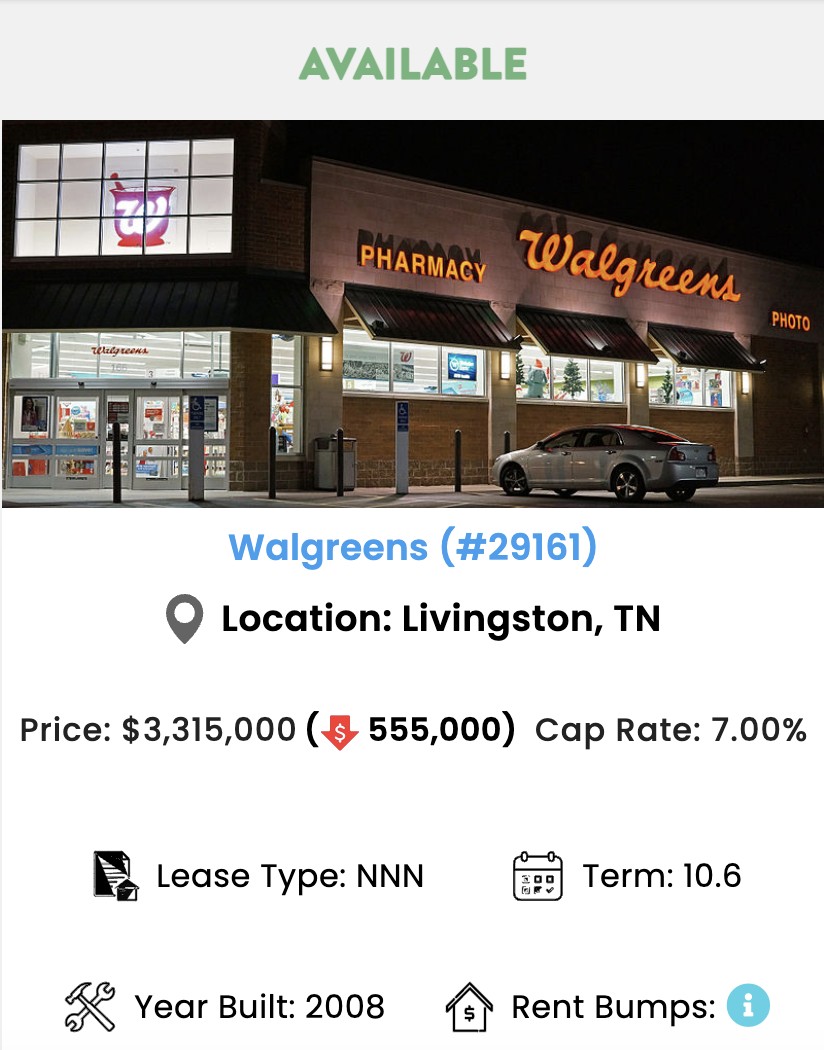

As you evaluate an NNN for sale in Tennessee, you will want to consider a number of factors, including property value, tenant strength, creditworthiness, and cap rate. As an illustrative example, let’s take a look at one of our current NNN properties listed in Livingston, TN.

This NNN property is currently home to a Walgreens. Like most NNN lease tenants in Tennessee, Walgreens is a large company with a strong balance sheet, so you can trust that your monthly rent payment will arrive on time. This property is priced at $3.3M, which is slightly above the average in Tennessee – however, this property is a prime corner location with lots of daily vehicle traffic, and there are 10.6 years remaining on the net lease.

Let’s also take a look at the cap rate, or capitalization rate. This figure assesses a real estate investment based on its profitability and its return potential. Generally speaking, cap rates between 5% and 10% are preferred by commercial real estate investors. Lower rates within that range typically indicate a lower-risk investment. A mid-range or higher rate may come with more risk, but it could also mean more potential for reward.

Looking at this Livingston, TN Walgreens NNN property, you can see that it has a cap rate of 7%. This falls in the higher end of acceptable cap rates, meaning that you can potentially expect to see a higher return with this property.

You’ll also see the NOI listed for this property at $232,500 annually. In real estate, NOI stands for “net operating income,” which tells you as the owner how much money you could make from renting out this property.

With the stated NOI in mind, it would take about 14 years for this property to pay for itself. However, this tenant seems likely to remain in place and even extend the 10-year term left on the lease, as the tenant has been there since 1970.

Want more help with buying an NNN property in Tennessee? Call us at +1 (800) 443-0507

What Makes Tennessee an Attractive State for NNN Leases?

Tennessee is a very attractive state for NNN properties due to its steady population growth, low tax burden, and increasing number of business entities. Tennessee’s population is currently growing by just over 1% year over year. Research from the University of Tennessee suggests that the state’s population will exceed 8 million by 2040.

Additionally, Tennessee boasts a very favorable tax environment, coming in as the second-best state (after only Alaska) in terms of individual tax burden. U.S. News & World Report discovered that the average American paid 8.9% of their income in state taxes in 2020. In Tennessee, that number is significantly below the average, coming in at just 6.33%.

In 2023, CNBC named Tennessee the third-best state in the nation for business. Commenting on the state’s major accomplishment of growing new business rates for 10 consecutive years, Tennesse’s Secretary of State Tre Hargett commented:

“To grow new businesses for 40 consecutive quarters is no small feat. It is a testament to Tennessee entrepreneurs and to our state leaders who have created a business-friendly environment that encourages investment and jobs. Tennessee has become a magnet for people nationwide and I am encouraged about the future of our great state.”

Discover More NNN Properties for Sale in Tennessee

With its strong business environment offering a prime environment for lucrative commercial real estate investment, Tennessee presents investors with ideal NNN lease opportunities. Choosing an NNN lease reduces your risk and exposure as a real estate investor while allowing you to take advantage of property ownership in Tennessee’s hottest cities.

Don’t miss out on the top triple net properties for sale in Tennessee. Explore more Tennessee NNN listings right here, and discover opportunities in various industries. From Nasvhille to Chattanooga, Net Lease Finder will help you find the perfect Tennessee NNN investment.