Huddle House NNN Properties for Sale

A beloved American diner chain, Huddle House has been serving up comforting meals and Southern hospitality for decades. Known for its “any meal, any time” philosophy, Huddle House has cultivated a loyal customer base across the United States, particularly in the Southeast. Since its founding in Decatur, Georgia, in 1964, Huddle House has become a familiar and reliable presence in communities, offering a welcoming atmosphere and a diverse menu.

Huddle House restaurants typically feature a sit-down dining model, providing a comfortable space for families, travelers, and locals alike to enjoy breakfast, lunch, and dinner around the clock. This established brand recognition and consistent customer traffic contribute to the stability and appeal of Huddle House as a net lease tenant.

Huddle House operates nearly 300 locations across the US, with almost all of them located in the Southeast states (Georgia, Alabama, Florida, etc.).

Huddle House Tenant Overview

Huddle House presents a compelling opportunity for triple net lease investors due to its long-standing history, widespread brand recognition, and consistent performance within the casual dining sector. With a business model focused on providing accessible and affordable meals in a welcoming environment, Huddle House has demonstrated resilience and sustained customer loyalty over many years.

The traditional sit-down restaurant format of Huddle House locations typically involves larger building footprints compared to many QSR/fast food “drive-thru-only” concepts. Huddle House locations are often strategically located in areas with good visibility and accessibility to cater to their broad customer base.

As an established franchise system, Huddle House benefits from a well-defined operational model and brand standards, contributing to the consistency and reliability that investors look for in a stable net lease investment. The longevity of the brand and its deep roots in many communities further solidify its credibility as a dependable tenant.

| Huddle House NNN Lease at a Glance | |

| Average sale price | $1,600,000 |

| Average NOI (net operating income) | $100,800 yearly |

| Average cap rate | 6.3% |

| Average square feet | 1,900 – 2,800 |

| Average lot size | 0.5 – 1.3 acres |

| Typical lease term | 15 – 20 years |

| Escalators | Negotiable bumps every 5 years |

| Typical location | Often located on well-trafficked thoroughfares, near residential areas, and in retail corridors to maximize visibility and accessibility. Standalone buildings are common. |

| Ticker symbol | N/A (privately held) |

Huddle House Typical Lease Structure

Investing in a Huddle House net lease offers a chance to own a property leased to a well-established and recognized brand in the restaurant industry. These Huddle House NNN tenants typically sign long-term net leases, usually ranging from 15 to 20 years, with built-in rent escalations every five years.

Similar to other NNN leases, a Huddle House lease structure typically passes the responsibilities for property maintenance, real estate taxes, and building insurance directly to the tenant. This “triple net” arrangement provides landlords with a truly passive income stream, minimizing day-to-day management responsibilities

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

Why Invest in a Net Lease Rather Than a Gross Lease in Commercial Real Estate?

When you are investing in commercial real estate, you will quickly discover that net leases offer investors the opportunity for more passive income and fewer headaches than gross leases. These two lease types are often considered opposites. Let’s break it down…

Gross lease: A rental agreement in which the tenant pays a predetermined amount in order to use the landlord’s property. That fixed amount does not fluctuate due to operating expenses, as the landlord covers property taxes, maintenance, and insurance.

Net lease: A rental agreement where the tenant takes on some or all of the above-mentioned operating expenses (taxes, insurance, and maintenance) in addition to a base rent that is usually lower. There are three tiers of net leases, each of which passes additional expenses onto the tenant, absolving the property owner of more risk. As you’ll see, NNN leases are popular because they offer less risk for the landlord, even though the base rent is normally lower.

- N lease: The tenant covers base rent and property taxes, while the landlord pays for maintenance and insurance.

- NN lease: The tenant is responsible for base rent, taxes, and insurance. The landlord still has to pay for maintenance.

- NNN lease: The tenant is responsible for base rent in addition to taxes, maintenance, and insurance. The landlord does not have to worry about any operating expenses.

How to Secure Financing for a Huddle House Net Lease

Financing for Huddle House NNN properties is available through various lenders and loan programs, including traditional banks as well as lenders that are specifically focused on handling commercial real estate transactions. Most NNN properties are purchased with some amount of debt, so it is normal to need financing to purchase a Huddle House net lease.

As you look into securing NNN financing for a Huddle House net lease, there are a few factors that lenders will look at, including…

- The tenant’s net operating income – will the tenant be successful enough to stay in the property and keep paying you rent?

- The quality of the property – does the property meet the tenant’s typical preferences that will allow it to be successful?

- The tenant’s business model – are they likely to last?

- The details of the lease – are there rent bumps and escalations? How long is the term?

Looking at these factors helps lenders assess whether or not they want to give you a loan. If we consider these questions for Huddle House as a tenant, their 50-year track record makes them a promising investment prospect.

To be approved for financing, you’ll also need to qualify through your own financial situation with the following factors:

- Net worth of $1 million or more, OR annual income over $200,000 (over $300,000 if you are married and file taxes jointly)

- Able to provide down payment between 30% and 40% of the loan’s total value

- Acceptable credit score

Federally insured banks or credit unions will usually provide your best loan options. Federal interest rates for NNN mortgages are currently sitting at about 6.45%. As long as you meet your lender’s financial requirements and have a high-quality property, you should be able to get financing for your Huddle House NNN lease.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

How to Evaluate a Huddle House Net Lease

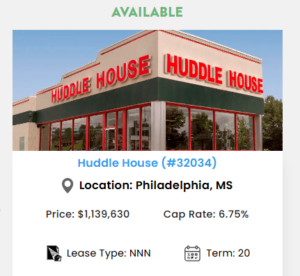

When evaluating a Huddle House NNN for sale (or any triple net lease), we recommend looking at factors like property value, tenant strength, creditworthiness, and cap rate. As an example, let’s consider a Huddle House NNN for sale in Mississippi…

Example Huddle House NNN Lease

This Huddle House location in Philadelphia, MS, is listed for $1,139,630 with a cap rate of 6.75%. The 6.75% cap rate figure looks at the profitability and return potential of a real estate investment.

Typically, cap rates of 5% to 10% are considered good – so this 6.75% cap rate is impressive, indicating a strong potential return relative to the property’s price. Investors have a clear opportunity for attractive returns with this offering.

Loan Details (Assuming 35% Down Payment & 6% Interest Rate)

Let’s project the financial performance based on the provided listing details:

- Purchase Price: $1,139,630

- Cap Rate: 6.75%

- Estimated Annual NOI (Net Operating Income): $1,139,630 * 0.0675 = $76,925

- Typical Lease Term (from listing): 20 years

Assuming a 35% down payment and a 6.00% interest rate on the loan:

- Down Payment: $1,139,630 * 0.35 = $398,870.50

- Loan Amount: $1,139,630 – $398,870.50 = $740,759.50

- Interest Rate: 6.00%

- Loan Term: (Assuming a 25-year amortization for typical commercial mortgages)

- Annual Loan Payments: ~$57,300 (calculated using a standard amortization schedule for $740,759.50 at 6.00% over 25 years)

Investment Summary

With an estimated annual NOI of approximately $76,925 and projected annual loan payments of around $57,300, the investor would generate a net cash flow of approximately $19,625 per year after debt service.

This NNN lease structure allows the investor to own a highly passive income property, as the tenant is responsible for all property expenses (taxes, insurance, and maintenance) for the 20-year term. Over time, the investor builds equity while earning steady returns, making this Huddle House lease a solid long-term investment.

Like many established NNN tenants with a long operating history, Huddle House is a recognized brand with a loyal customer base. You can typically count on this tenant to pay rent on time for the duration of the long lease, contributing to a stable commercial real estate investment for you.

What Makes Huddle House an Attractive NNN Tenant?

Huddle House benefits from decades of brand recognition and a strong presence in numerous communities, particularly in the Southeast. Its focus on providing affordable, accessible meals at any time of day has fostered a loyal customer base. This established operational model and community integration contribute to the stability and appeal of Huddle House as a long-term tenant, offering investors consistent revenue from their commercial property.

If you are seeking a stable and recognized tenant in the casual dining sector for your next commercial real estate investment, a Huddle House NNN for sale presents a compelling opportunity.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|