Family Dollar NNN For Sale

Family Dollar is a well-known chain of discount retailers in the U.S. It was acquired by Dollar Tree in July of 2015, and in combination, the two stores comprise the nation’s largest small-box retailer. Dollar stores, and discount retail in general, have become increasingly important in the national retail landscape in recent years.

As of 2025, Family Dollar continues to expand its footprint, with over 8,000 stores nationwide. The company remains a key player in the discount retail sector, catering to budget-conscious consumers in suburban and rural markets.

Family Dollar has a high level of brand recognition and many loyal, value-motivated customers who rely on spending their budget at the store to purchase necessities at reduced prices. The locations typically carry about 7,000 basic household items and necessities alongside other seasonally relevant items that change throughout the year.

From the real estate perspective, Family Dollar is a burgeoning business with a growing customer base that depends on its products. While other industries can be hurt by economic turmoil, discount retail is one area that tends to remain strong. For this reason, a Family Dollar NNN lease can be an excellent passive income real estate investment.

Tenant Overview

Freestanding Family Dollar retail stores provide an attractive combination of features when it comes to commercial real estate. They offer long-term leases that, combined with their growing market concept and fleets of value-conscious shoppers, make them hard to pass up. That explains why they’ve become such a popular NNN lease tenant in recent years.

Family Dollar generally sets up shop in low to middle-income neighborhoods in both suburban and rural areas where it can attract a large customer base. The stores are standardized in terms of layout across all locations so that customers are able to find products easily and staff can focus on other features of customer service.

Although their stores are located in tertiary markets, Family Dollar offers attractive NNN lease terms and a high cap rate. These attributes mean it can be a great opportunity for a high return on investment.

| Family Dollar NNN Lease at a Glance | |

| Average sale price | $1,578,416 |

| Average NOI (net operating income) | $112,541 yearly |

| Average cap rate | 7.13% |

| Average square feet | 6,000 - 8,000 |

| Average lot size | 0.5 - 1.5 acres |

| Typical lease term | 15 years |

| Escalators | 10% every 5 years after year 10 |

| Typical location | Suburban and rural locations with low or middle household income levels |

| Ticker symbol | NASDAQ: DLTR |

Family Dollar Lease Structure

Historically, Family Dollar has offered NN leases that require minimal responsibilities from the landlord, generally limited to building and property maintenance. That said, the company is shifting over to an NNN lease model for many of its newer stores, meaning that the tenants assume the responsibility of this maintenance.

Family Dollar usually favors a 15-year initial term with renewal options every five years after the initial term expires. Newer leases are using a price escalator model that involves a 10% bump every five years after the first ten years.

The average cap rate, or capitalization rate, for a Family Dollar lease is 7.13%. In this context, a cap rate assesses an NNN investment’s profitability and return potential. Generally, cap rates of 5% to 10% are considered good, so Family Dollar’s is within that magic range. With a cap rate higher than many of its competitors’, Family Dollar may provide a quicker return on investment.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

Why Choose a Net Lease Over a Gross Lease When Investing in Commercial Real Estate?

There are a few different types of leases to consider in the world of commercial real estate. You’ll likely find out pretty quickly that there are many benefits to choosing to use a net lease, generally considered the opposite of a gross lease.

A gross lease means a tenant will pay a predetermined amount to use a space. That amount doesn’t change because of operating expenses, which typically fall to the landlord. On the flip side, net leases allow landlords to pass operating expenses on to their tenants.

Net leases are a big win for landlords: tenants cover operating expenses like taxes, insurance, and maintenance, while landlords enjoy predictable income with fewer responsibilities.There are three tiers of net leases: single, double, and triple. These categories are also called N, NN, and NNN leases. Each level involves the landlord passing additional expenses over to the tenant, exposing the property owner to less and less risk as the net lease levels increase.

Single net leases, or N leases, pass only property taxes onto the tenant in addition to them paying the cost of rent. The landlord retains responsibility for other costs related to insurance, maintenance, repairs, and utilities. N leases are less common for commercial real estate. Double net leases, or NN leases, and triple net leases, or NNN leases, are far more common.

What Types of Net Leases Does Family Dollar Operate Under?

Throughout its lifespan, Family Dollar has signed various types of leases. Traditionally, the stores have operated under NN leases, meaning that landlords were responsible for roof and structural repairs. But today, Family Dollar has changed its strategy.

Its newer leases, which usually have 15-year initial terms, are normally NNN leases. NNN leases are generally the most attractive type of lease for property owners. That’s because they hold the tenant accountable for paying operating expenses and costs related to the property, which can include insurance, property taxes, and structural maintenance or repairs.

Family Dollar’s NN leases are a slightly less attractive option. That’s because, with an NN lease, the tenant is responsible for only rent, insurance, and property taxes – so the property owner is on the hook for structural maintenance and repairs. Those types of repairs can be pricey and urgent when the need arises, especially big-ticket improvements like roofing.

With a Family Dollar NNN lease, a tenant will often pay a lower base rent since they’re responsible for the operating costs. That said, NNN leases also reduce the responsibilities related to property management by passing the majority of responsibilities onto the tenant.

How to Evaluate a Family Dollar Net Lease

Regardless of which tenant you’re considering, it’s crucial to evaluate both property value and tenant strength when you’re considering an NNN lease. This is especially important when you’re looking at single-tenant properties like the ones Family Dollar prefers. With single-tenant properties, your tenant concentration will be 100% or 0% – in other words, you’ll be generating maximum cash flow or none at all.

For that reason, it’s important to ensure that your investment property meets the qualifications that Family Dollar prefers in its locations, including being situated in low or medium income areas in suburban or rural environments where the store can establish a strong customer base. Meeting those criteria will help ensure that the property stays occupied.

How to Evaluate a Family Dollar Net Lease

Regardless of which tenant you’re considering, it’s crucial to evaluate both property value and tenant strength when you’re considering an NNN lease.

This is especially important when you’re looking at single-tenant properties like the ones Family Dollar prefers. With single-tenant properties, your tenant concentration will be 100% or 0% – in other words, you’ll be generating maximum cash flow or none at all.

Taking over a current net lease ensures that the property meets the qualifications that Family Dollar prefers in its locations, including being situated in low or medium income areas in suburban or rural environments where the store can establish a strong customer base. Since a currently occupied lease already meets this criteria, it will help ensure that the property continues to stay occupied.

This, combined with Family Dollar’s strong financials and investment-grade credit rating, makes them a reliable tenant, reducing the risk of lease defaults.

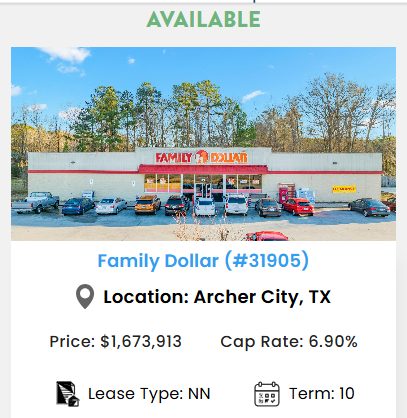

Real-Life Example: Family Dollar NNN Lease in Archer City, Texas

Let’s walk through a real-life example of a Family Dollar NNN property in Texas. Located in Archer City, TX, this property offers a prime opportunity for investors looking to add a stable, recession-resistant asset to their portfolio.

Priced at $1,673,913, this Family Dollar location boasts a 6.90% cap rate, making it an attractive option for investors seeking strong returns. In other words, this lease will put approx. $115,500 in your pocket every year, and allow you to pay it off in 14-15 years, assuming no big expenses come along.

While this particular lease is structured as an NN lease, meaning the landlord is responsible for structural and roof repairs, Family Dollar’s strong brand recognition and loyal customer base ensure consistent cash flow, while the 10 years remaining on the lease provide long-term stability.

For investors interested in NNN properties in Texas, this Family Dollar location exemplifies the potential for passive income and portfolio diversification. With its high cap rate and prime location in a growing market, it’s a standout opportunity in the world of net lease investments.

What Makes Family Dollar an Attractive NNN Tenant?

In its 2024 fiscal year, Dollar Tree Inc. (the subsidiary that owns Family Dollar) reported revenue of $30.6 billion, an 8% increase from the previous year. This strong revenue, along with high profit margins, allows Dollar Tree to continue paying off all of its expenses, including the rent cheques to its Family Dollar NNN landlords (which could be you!)

Overall, Family Dollar is a high quality NNN lease tenant with a bright future. It’s resistant to economic strain, and its tertiary market locations and high cap rate provide an attractive option for an impressive return on investment.

Ready to invest in a Family Dollar NNN lease? Explore our available properties today and start building your passive income portfolio!