Bojangles NNN for Sale

Bojangles is a fast-food restaurant that is best known for their Cajun-seasoned fried chicken and buttermilk biscuits, and primarily serves customers in the southeast United States.

The chain’s fan favorite Southern-style chicken has been the backbone of the menu since the company first began in 1977. In the nearly 40 years since, Bojangles has experienced rapid growth and now boasts over 700 franchise locations, with 93% of their stores owned by multi-unit franchisees.

The first Bojangles restaurant was in Charlotte, North Carolina – but now, the franchise has spread throughout the country, with locations in seventeen states ranging from Ohio to Texas. Expansion is planned in the near future into Arizona, California, Nevada, and New Jersey.

Bojangles Tenant Overview

A big draw of a commercial real estate Bojangles lease for sale is the brand’s cult following and strong expansion plan that has been underway over the past few years. In 2023, Bojangles saw 270 new locations added to their pipeline and opened 40 new restaurants, 10 of which were in new markets. Plus, the restaurant chain differentiates itself by offering breakfast – nearly 40% of sales come in before many competitors even open their doors.

While the QSR industry is certainly crowded, Bojangles stands out due to countless accolades, such as its coveted position on Entrepreneur magazine’s Franchise 500 list. It was also ranked among the top chicken franchises by the magazine.

| Bojangles NNN Lease at a Glance | |

| Average sale price | $2,487,000 |

| Average NOI (net operating income) | $148,278 yearly |

| Average cap rate | 5.88% |

| Average square feet | 3,300 – 3,800 |

| Average lot size | 0.8 – 1.5 acres |

| Typical lease term | 15 years |

| Escalators | Variable, often every 5 years |

| Typical location | Corner lots or parcels near established retail corridors with enough room for a drive-thru. Expanding into non-traditional locations. |

| Ticker symbol | N/A (privately held) |

Bojangles Typical Lease Structure

Choosing a Bojangles NNN lease is an excellent way to get into the commercial real estate sector, as these booming chicken and biscuit restaurants are exploding across the country. The typical Bojangles lease structure involves 15-year NNN leases with escalators on a five-year schedule, although the escalation percentage and timeline is normally negotiable.

Additionally, Bojangles franchise agreements are typically 20 years long – so as long as the location is thriving on your property, you can often expect the lease to be extended. With NNN leases, the tenant is responsible for items like maintenance, taxes, and insurance, making a Bojangles NNN lease a strong passive investment for any landlord.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

Is Investing in a Net Lease Better Than a Gross Lease?

In the world of commercial real estate, net leases are typically considered a preferable option for landlords. Net leases offer real estate investors more passive income and fewer headaches when compared with gross leases. To better understand why net leases are preferable, let’s compare these two main lease types.

Under a gross lease, the tenant pays a fixed rent, similar to the typical structure of residential real estate leases – think of renting an apartment or condo. The landlord is responsible for operating expenses associated with the property (taxes, insurance, and maintenance).

Under a net lease, the tenant takes on some or all of those operating expenses in addition to a base rent that is usually lower than what you would see in a gross lease. Although net leases typically come with a lower base rent, they offer more stable and predictable income for the landlord, because there is no fluctuation due to operating expenses.

There are three tiers of net leases, each of which passes more expenses onto the tenant and thus absolves the property owner of more risk. As you’ll see, NNN leases are popular because they offer the least amount of risk for the landlord:

- N lease: The tenant pays for base rent and property taxes. The landlord pays for maintenance and insurance.

- NN lease: The tenant pays for base rent, taxes, and insurance. The landlord pays for maintenance.

- NNN lease: The tenant pays for base rent in addition to taxes, maintenance, and insurance. The landlord is not responsible for any operating expenses.

How to Secure Financing for a Bojangles Net Lease

When you’re looking for financing for your Bojangles NNN property, you should explore various channels and loan programs. Both traditional banks and lenders that are specifically focused on handling commercial real estate transactions can offer financing for NNN lease properties. Most NNN properties are purchased with some amount of debt, so it is normal to need financing to get your hands on a Bojangles lease for sale.

As they evaluate your eligibility for financing for an NNN property, here are some of the factors that lenders will consider…

- Net operating income: Will the tenant be successful enough to afford your property and continue paying you rent?

- Property quality: Does your property meet the tenant’s typical requirements that have proven successful in the past?

- Business model: Is the tenant likely to remain in business or are they at risk of closure?

- Lease details: Are there rent escalations? How long is the term?

In addition to these tenant- and lease-related questions, you (or your commercial real estate company) will need to show your own qualifications, including:

- Personal net worth: Do you have a net worth of at least $1 million OR annual income above $200,000 (over $300,000 if you are married and file taxes jointly)?

- Down payment: Are you able to provide a down payment between 30% and 40% of the loan’s total value?

- Credit score: Do you have a proven track record of responsible paying off debt?

Federally insured banks or credit unions are trustworthy places to get a loan. Federal interest rates for commercial mortgages are currently sitting between 5.46% and 6.77% as of March 2025. Provided that you meet your lender’s requirements both personally and in your lease, you should be able to get financing for a Bojangles NNN lease property.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

How to Evaluate a Bojangles Net Lease

When evaluating a Bojangles NNN lease for sale, we suggest looking at factors like property value, tenant strength, creditworthiness, and cap rate. As an example, let’s consider a Bojangles NNN for sale in Tennessee…

Example Bojangles NNN Lease

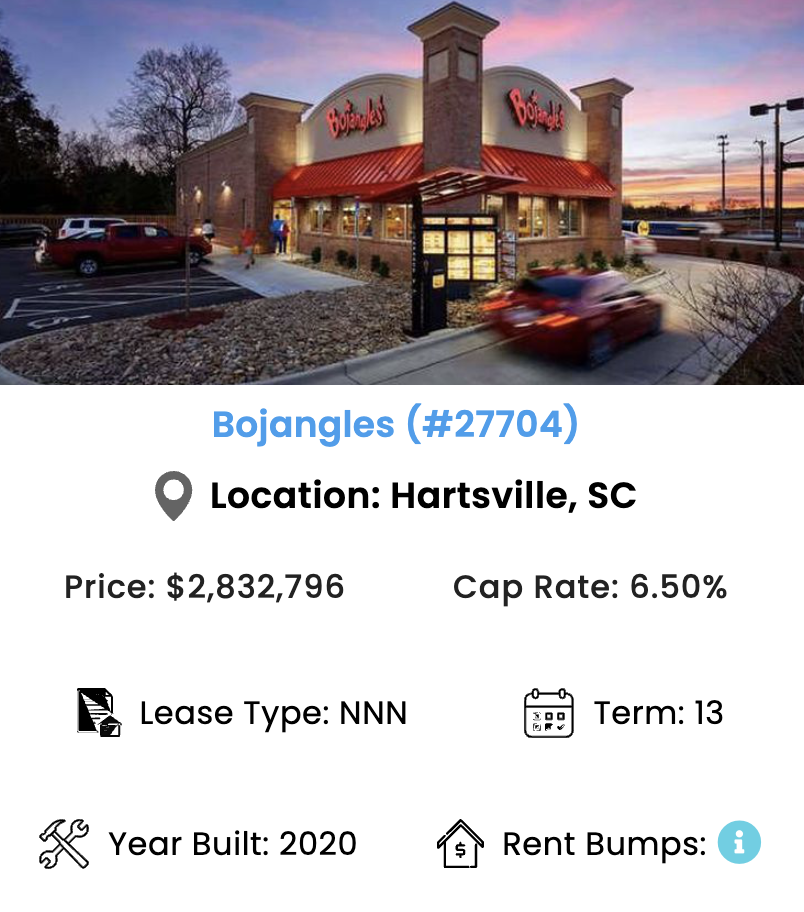

This Bojangles location in Hartsville, South Carolina is listed for $2.8M with a cap rate of 6.50%. Remember, the average cap rate, or capitalization rate, for a Bojangles NNN for sale is 5.88%. What does that mean? A cap rate looks at the profitability and return potential of a real estate investment. Cap rates between 5% and 10% are considered good – this 6.5% cap rate offers investors a chance to take on a slightly higher risk for the potential of a slightly higher return.

You will want to evaluate the property to ensure that it meets the brand’s location criteria, which can be a big predictor of success. Bojangles is looking for suburban locations along well-known retail corridors. They also like proximity to shopping centers with major anchor tenants and heavily trafficked thoroughfares. Large parking lots are essential for the drive-thru. If those boxes are checked, then your property might be a strong option for a Bojangles NNN lease.

Like many NNN tenants (such as Chick-fil-A or McDonald’s), Bojangles is a well-known company with a strong balance sheet and a devoted fan base. These large tenants are more likely to pay rent on time, making your commercial real estate investment a true source of passive income.

Find Your Bojangles NNN Property Today

With its enthusiastic fan base and growing popularity, Bojangles stands out as a strong NNN lease tenant. Its strong financial reporting and robust franchise development plan show that this company is poised for ongoing growth, meaning you’ll be able to count on revenue from your NNN property for years to come.

If you are searching for a high-quality commercial real estate tenant in the QSR and fast food space, a Bojangles NNN for sale is an excellent investment. So take a look through our Bojangles net leases and find your next investment today!

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|