McDonald's NNN For Sale

The McDonald’s golden arches are an American icon – and the fast food chain is an attractive NNN lease prospect when you’re looking to get into an investment that offers a low price point and rent increases during the primary term. As they say at McDonald’s: I’m lovin’ it.

While McDonald’s Corporation is now a global fast food giant, it was founded in 1940 as a humble restaurant run by brothers Richard and Maurice McDonald in San Bernardino, California. Today, it’s the world’s largest restaurant chain by revenue.

McDonald’s serves over 69 million customers each day and operates over 41,800 locations in more than 100 countries. It’s also the world’s second-largest private employer (behind only Walmart), with 1.9 million employees. In the list of American companies by total revenue, McDonald’s ranked #162 by bringing in $25.5B.

McDonald’s Tenant Overview

McDonald’s has both the size and the reach to provide investment opportunities with varying risk and return for net lease property investors. It has primary, secondary, and tertiary market locations, making it diverse in what it can offer in terms of corporate real estate.

For stand-alone restaurants, the company considers corner locations with ideal visibility and the opportunity to put up street signs on two major streets optimal. It requires ample parking spaces and prefers locations near major intersections with traffic signals.

As it approaches its 90th birthday, McDonald’s remains the dominant brand in the fast food space – also called the QSR, or “quick service restaurant,” space. Its most attractive features are its band recognition, operating stability, and strong credit rating.

Because McDonald’s often purchases their restaurant real estate instead of leasing it, there’s a lack of supply of McDonald’s NNN leases on the market, meaning that you’ll often find aggressive pricing. Like most QSR brands, McDonald’s franchises the majority of its locations (the current percentage is estimated at about 93%), but when they do lease, those leases are guaranteed on a corporate level.

If you’re looking into investing in corporate real estate with a McDonald’s location, you probably want to consider the factors outlined in the table below.

| McDonald's NNN Lease at a Glance | |

| Average sale price | $2,356,988 |

| Average NOI (net operating income) | $119,970 yearly |

| Average cap rate | 5.1% |

| Average square feet | 4,500 |

| Average lot size | 0.75 - 1.25 acres |

| Typical lease term | 20 years |

| Escalators | 10% - 15% every 5 years |

| Typical location | Near major interchanges and on lots with ample parking |

| Ticker symbol | NYSE: MCD |

McDonald's Lease Structure

McDonald’s uses a mixture of ground leases and NNN leases, often with rent increases of 10% to 15% every five years, though they’re negotiated on each individual lease.

For some leases, the rent is stable for the first ten years, and then those five-year increases ensue. Landlords are generally not responsible for maintenance or other property costs in both ground leases and NNN leases.

The average cap rate, or capitalization rate, for a McDonald’s lease is 5.1%. Cap rates analyze a real estate investment’s profitability and return potential. Generally, cap rates of 5% to 10% are considered good, putting McDonald’s just on the lower end of that “good” range.

All cap rates are not made the same. Generally speaking, higher cap rates are associated with higher risks, but McDonald’s is anything but a risky investment, which we’ll speak on a bit more later.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

Why Choose a Net Lease Over a Gross Lease When Investing in Commercial Real Estate?

There are a few different types of leases to consider when it comes to investing in commercial real estate, but you’ll find that there are many benefits to choosing to use a net lease. A net lease is generally considered the opposite of a gross lease.

A gross lease indicates that a tenant will pay a predetermined amount to use a space. That amount doesn’t change based on operating expenses, which the landlord is generally responsible for. Conversely, a net lease lets the landlord pass operating expenses over to the tenant.

There are three tiers of net leases: single, double, and triple. The listed categories are also referred to as N, NN, and NNN leases. Each level passes additional expenses over to the tenant, freeing the property owner from more and more risk as the levels increase.

Single net leases, or N leases, pass property taxes onto the tenant in addition to the cost of rent. The landlord is still responsible for insurance, maintenance, repairs, and utilities, however. N leases are less common for commercial real estate. Double net leases, or NN leases, and triple net leases, or NNN leases, are seen much more often.

What Types of Net Leases Does McDonald's Operate Under?

McDonald’s stores that have leases typically use ground leases or NNN leases with 20-year initial terms and three to five subsequent renewal periods. In these types of leases the tenant is responsible for paying property taxes, insurance, and maintenance expenses. This lease structure is similar to other big-name fast food tenants like Burger King and Taco Bell.

Ground leases usually involve undeveloped commercial land that is leased to tenants. Those tenants then have the right to develop on the property, meaning that they own the buildings and any property improvements they make. They still have to pay rent for the land, however, and if the lease expires, the buildings become the property of the landowner.

Some McDonald’s stores do operate under NNN leases. When working with an NNN lease, a tenant will generally pay a lower base rent. That’s because they’re responsible for all of the property’s operating costs. NNN leases reduce the burden of property management because they pass most of the responsibilities onto the tenant.

How to Evaluate a McDonald's Net Lease

When you’re considering an NNN lease or a ground lease, you’ll want to look at both property value and tenant strength. This is especially important when you’re looking at single-tenant properties like those that McDonald’s prefers. When you have only one tenant, your tenant concentration will be either 100% or 0% – so you’ll be making lots of cash or none at all.

For that reason, it’s important to ensure that your investment property meets the qualifications that McDonald’s is looking for in its locations. These criteria include high visibility, large parking lots, and locations near major intersections with traffic lights. That will make sure that your commercial property stays occupied.

Luckily, NNN lease tenants like McDonald’s are usually well-known companies that have strong balance sheets. You can generally depend on your payments arriving in a timely fashion, and you won’t be chasing down tenants to get your hands on your next check.

What Makes McDonald's an Attractive NNN Tenant?

When you’re considering an NNN lease or a ground lease, you’ll want to look at both property value and tenant strength. This is especially important when you’re looking at single-tenant properties like those that McDonald’s prefers. When you have only one tenant, your tenant concentration will be either 100% or 0% – so you’ll be making lots of cash or none at all.

For that reason, it’s important to ensure that your investment property meets the qualifications that McDonald’s is looking for in its locations. These criteria include high visibility, large parking lots, and locations near major intersections with traffic lights. That will make sure that your commercial property stays occupied.

Luckily, NNN tenants like McDonald’s are usually well-known companies that have strong balance sheets. You can generally depend on your payments arriving in a timely fashion, and you won’t be chasing down tenants to get your hands on your next check.

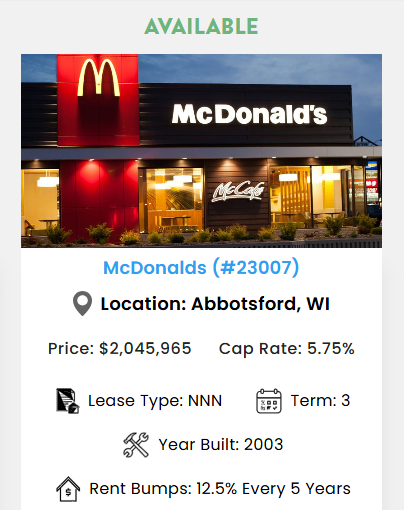

McDonald’s Net Lease Example

Let’s break down the financials of purchasing this McDonald’s NNN lease in Abbotsford, WI and see how it can be a strong investment opportunity.

Property Details

- Purchase Price: $2,045,965

- Net Operating Income (NOI): $117,643 per year

- Cap Rate: 5.75%

- Lease Type: NNN (tenant covers all property expenses)

- Years Remaining on Term: 3

Financing Assumptions

- Down Payment: 35% ($715,088)

- Loan Amount: $1,330,877

- Loan Term: 10 years

- Amortization Period: 25 years

- Interest Rate: 6.3%

- Annual Loan Payments: ~$105,767 per year

Investment Cash Flow Analysis

- NOI: $117,643

- Annual Loan Payments: ~$105,767

- Net Cash Flow (After Debt Service): $11,876 per year

This investment would generate cash flow out of the gate while allowing the investor to also build equity in the lease.

Exit Strategy Considerations

With only 3 years left on the lease, the main risk is the possibility of not coming to an agreement when it comes time for lease renewal. That’s why it’s important for the investor to look further into:

- The likelihood that McDonald’s plans to stay at this location long-term and renegotiate the term.

- Potential for securing a new tenant in the event that McDonald’s decides not to renew their lease.

This McDonald’s NNN lease is a positive cash flow asset with strong brand security and minimal landlord responsibilities, and makes a very strong investment due to the high likelihood of lease renegotiation.

What Makes McDonald's an Attractive NNN Tenant?

McDonald’s and its golden arches have been around for more than 85 years, and that time has paid off in terms of its strong brand recognition and loyal customer base. McDonald’s combines those qualities with stable financials and a strong credit rating. To top it off, some of the leases offer a low price point that makes the restaurant a very attractive NNN lease tenant (due to requiring less of a down payment).

McDonald's reported over $130 billion in revenue in 2024. Analysts remain optimistic about McDonald's long-term outlook, citing its brand strength, adaptability, and continued growth in key markets. Thanks to this optimism, the company's stock has already seen strong growth to start 2025.

As a whole, McDonald’s is a high-quality, investment-grade tenant that will likely be making their rent checks and keeping locations open for a very, very long time. This makes McDonald’s a company that you’ll want to invest in!