7-Eleven NNN Properties For Sale

From its humble beginnings as an icehouse in 1927, 7-Eleven has grown to become one of America’s most recognizable convenience store chains. In fact, it’s the world’s largest operator, franchisor, and licensor of convenience stores.

But brand recognition isn’t the only factor that makes 7-Eleven an extremely popular option for NNN leases. Their leases are backed by a corporate guarantee, making them even more attractive. Plus, the company has a solid credit rating and a preference for high-quality real estate, meaning there’s plenty of room for return on investment.

Tenant Overview

7-Eleven is a privately owned company. It’s completely owned by Seven&i Holdings Co. Ltd, which is traded on the Tokyo Stock Exchange. That said, it has a solid credit rating, with Standard & Poor’s giving it an A. The company has good taste in real estate, too.

For all of its locations, 7-Eleven prefers corner lots with high visibility and easy ingress and egress, making them highly accessible to passersby. They like sites that get at least 25,000 vehicles driving by each day.

It’s important to note that there’s a difference between 7-Eleven locations that offer fuel and 7-Eleven locations that do not. For locations that do offer fuel, the company usually wants ground leases at corner locations or outparcel sites at highly trafficked shopping centers. Lot sizes can range from 0.8 to 1.0 acres of land for gas station sites.

Want help investing in a 7-Eleven NNN property? Call us at +1 (800) 443-0507

The company has also been developing and expanding its “C-store” model, which is a non-gas station convenience store. Those locations offer a more compact profile, with sites that can fit onto smaller parcels. C-store locations usually have average square footage between 1,500 and 2,000.

| 7-Eleven NNN Lease Overview | |

| Average sale price | $5,832,114 |

| Average NOI | $278,191 yearly |

| Average cap rate | 4.77% |

| Average square feet | 2,500 - 3,500/td> |

| Average lot size | Varies depending on gas component |

| Typical lease term | 10 - 20 years |

| Escalators | 10% - 15% every 5 years |

| Typical location | Urban and suburban locations with over 25,000 passing vehicles per day |

| Ticker symbol | N/A |

7-Eleven Lease Structure

7-Eleven leases typically range from 10 to 20 years, and they’re usually structured as NNN leases. They often include approx. 10% rent escalations every five years, making them appealing to investors seeking long-term, predictable income.

Cap rates for 7-Eleven properties currently average around 4.77%, though properties in prime urban locations or high-growth markets may trade at lower yields (because they’re seen as a more secure investment). Investors should assess the lease terms carefully, especially when evaluating sites with gas stations versus those without.

These 10% rent escalations make 7-Eleven an awesome net lease tenant, thanks to the constantly growing passive income.

Why Choose a Net Lease Over a Gross Lease When Investing in Commercial Real Estate?

For commercial real estate investors, there are many benefits to choosing a net lease over a gross lease. These two types of leases are often considered opposites.

A gross lease involves a predetermined amount that a tenant pays in order to use a space. It doesn’t change due to operating expenses, since landlords generally cover those costs. On the other hand, net leases allow landlords to hand off operating expenses to their tenants.

There are three tiers of net leases: single, double, and triple. They’re also called N, NN, and NNN leases. Each level allows the landlord to pass more and more expenses to the tenant, absolving the landlord of increased risk as the tiers increase.

Single net leases (N leases) pass property taxes over to the tenant in addition to the cost of rent, but landlords remain responsible for insurance, maintenance, repairs, and utilities. N leases are less common when it comes to commercial real estate. Double net leases (NN leases) and triple net leases (NNN leases) are much more common.

What Types of Net Leases Does 7-Eleven Operate Under?

7-Eleven has exhibited a preference for ground leases with initial terms ranging from 10 to 20 years, during which the rent bumps up every five years. Ground leases are similar to NNN leases in the sense that the tenant is responsible for property taxes, insurance, and maintenance expenses.

The difference between the two is that ground leases often involve undeveloped commercial land that is leased to tenants. Said tenants then have the right to develop the property, meaning that they own the buildings there. They still have to pay rent for the land, however, and if the lease expires, the buildings become the property of the landowner.

When working with an NNN ground lease, a tenant like 7-Eleven will generally pay a lower base rent, because they’re responsible for all of the property’s operating costs and the development of the property. NNN leases reduce the burden of property management by passing many responsibilities to the tenant.

How to Evaluate a 7-Eleven Net Lease

When you’re considering an NNN lease, it’s crucial to analyze both the property value and the tenant's strength. Especially when you’re reviewing single-tenant properties like the ones many new 7-Eleven locations are situated on, your tenant concentration can be only 100% or 0%. In other words, you’ll be generating 100% of your potential cash flow or absolutely none of it.

In order to ensure that your 7-Eleven NNN lease pans out, you’ll want to make sure that the property you’re investing in meets the qualifications that 7-Eleven prefers in its locations – high-visibility corner locations with over 25,000 passing vehicles per day and easy access. That will help ensure that your property stays occupied and you continue getting paid.

On the plus side, NNN lease tenants like 7-Eleven are typically large companies with strong balance sheets, meaning that you can count on your payments arriving on time each month. You won’t be chasing down your tenants to get your hands on your monthly check.

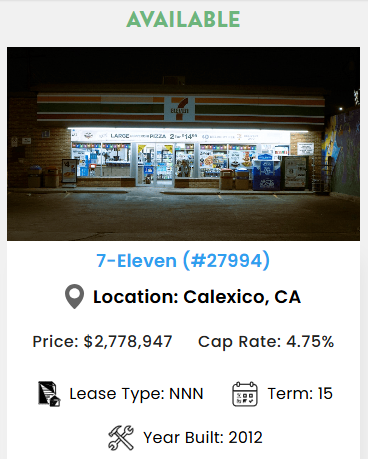

7-Eleven NNN Lease Example

Let’s look at how financing a 7-Eleven NNN lease can lead to long-term financial success.

- Purchase Price: $2,778,947

- Cap Rate: 4.75%

- NOI: $131,496 per year

- Loan: 10 years at 6.3% interest (up to date as of February 2025) amortized over 25 years

- Down Payment: 40% ($1,111,579)

- Loan Amount: $1,667,368

- Annual Loan Payments: ~$227,000

With a NOI of $131,496, the investor would only need to cover $2,100 per year out-of-pocket for the first 10 years. After 10 years, you’d be able to refinance and potentially be earning a profit from the lease if you can secure a better rate.

The best part is that paying off this slight excess leads to a huge long-term gain—fully owning a $2.8 million property once the loan is paid off.

This means turning an initial $1.1 million investment into a multimillion-dollar asset while securing steady passive income—likely far higher than today’s $131,496—for years to come. Investing in a stable, high-traffic tenant like 7-Eleven ensures strong appreciation potential and long-term financial security.

And this is only one of our NNN properties for sale in California. There’s more where that came from!

What Makes 7-Eleven an Attractive NNN Tenant?

7-Eleven is a well-known convenience store business with a high level of brand recognition in America. It combines strong visibility with stable financials and top-tier locations, making it an attractive option for an NNN lease.

With nearly $80B in revenue in 2024, 7-Eleven isn’t having trouble paying the lease rent. And with a credit rating of A from Standard & Poor, it’s an attractive tenant to lenders.

And the company isn’t looking to slow down, with plans to open 500 new stores between 2025 and 2027. As they continue expanding, they’re reaching exciting new heights. Today, over 50% of the U.S. population lives within 2 miles of a 7-Eleven store.

With its reach expanding, it looks like 7-Eleven has a bright future ahead. And the company’s bright future ahead makes it a great option for an NNN lease.

Take a look through our 7-Eleven net lease properties today, and you might just find your next great investment.