7 Brew NNN Properties For Sale

A coffee chain known for its extensive menu and friendly, fast, fun service, 7 Brew has a dedicated fan base in the states where it has made a home. The original 7 Brew stand was in Rogers, Arkansas – but in 2021, the brand started franchising locations to spread the love for 7 Brew across the nation.

Its drive-thru model makes it easy for customers to enjoy these tasty and unique drinks.

7 Brew now has over 300 locations across the United States, with most of its shops concentrated in the Midwest area. The company was recently recognized as the “Breakout Brand of the Year” by QSR Magazine, and according to Berkshire Hathaway, it was ranked it the fastest-growing brand in the U.S. in 2024.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

7 Brew Tenant Overview

A big part of 7 Brew’s appeal as a triple net lease tenant is its strong fanbase and impressive growth over the past four years since the company began franchising locations. The drive-thru model (locations do not have any indoor spaces for customers) makes it easy for the so-called “stands” to efficiently serve customers, leading to high net operating incomes.

While the 7 Brew buildings themselves are small, the chain requires large lots to accommodate its double drive thru lanes as well as easy ingress and egress.

Additionally, major investors like Jimmy John Liautaud, the founder of Jimmy John’s sandwich shop, and Jamie Coulter, the founder of Lone Star Steakhouse, have put their money behind 7 Brew. This further legitimizes the brand and highlights its credibility as a lasting tenant.

| 7 Brew NNN Lease at a Glance | |

| Average sale price | $2,000,000 |

| Average NOI (net operating income) | $500,000 yearly |

| Average cap rate | 6.45% |

| Average square feet | 500 square feet |

| Average lot size | 8,000 - 50,000 square feet |

| Typical lease term | 15-20 years |

| Escalators | Negotiable bumps every 5 years |

| Typical location | Suburban locations, often modular buildings with high through traffic, outparcels to shopping centers with big anchor tenants, corner lots with high visibility and large parking lots to accommodate drive-thru lanes |

| Ticker symbol | N/A (privately owned) |

7 Brew Typical Lease Structure

Choosing a 7 Brew net lease is an excellent way to get into the commercial real estate game, as these hot new beverage shops are opening up across the country. In 2023 alone, the chain reported 193 openings, a record for the quick service restaurant industry.

These 7 Brew NNN tenants typically sign 15-20 year NNN leases with escalators on a five-year schedule. With a NNN lease, responsibilities like maintenance, taxes, and insurance are passed on to the tenants, making a 7 Brew NNN lease an enviable passive investment for the landlord. However, some 7 Brew leases are ground leases. In a ground lease, some

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|

Why Choose a Net Lease Over a Gross Lease When Investing in Commercial Real Estate?

When you are investing in commercial real estate, you will quickly discover that net leases offer investors the opportunity for more passive income and fewer headaches than gross leases. These two lease types are often considered opposites. Let’s break it down…

Gross lease: A rental agreement in which the tenant pays a predetermined amount in order to use the landlord’s property. That fixed amount does not fluctuate due to operating expenses, as the landlord covers property taxes, maintenance, and insurance.

Net lease: A rental agreement where the tenant takes on some or all of the above-mentioned operating expenses (taxes, insurance, and maintenance) in addition to a base rent that is usually lower. There are three tiers of net leases, each of which passes additional expenses onto the tenant, absolving the property owner of more risk. As you’ll see, NNN leases are popular because they offer less risk for the landlord even though the base rent is normally lower.

- N lease: The tenant covers base rent and property taxes, while the landlord pays for maintenance and insurance.

- NN lease: The tenant is responsible for base rent, taxes, and insurance. The landlord still has to pay for maintenance.

- NNN lease: The tenant is responsible for base rent in addition to taxes, maintenance, and insurance. The landlord does not have to worry about any operating expenses.

How to Secure Financing for a 7 Brew Net Lease

Financing for 7 Brew NNN properties is available through various channels and loan programs, including traditional banks as well as lenders that are specifically focused on handling commercial real estate transactions. Most NNN properties are purchased with some amount of debt, so it is normal to need financing to purchase a 7 Brew lease for sale.

As you look into financing a 7 Brew net lease, there are a few factors that lenders will look at, including…

- The tenant’s net operating income – will the tenant be successful enough to stay in the property and keep paying you rent?

- The quality of the property – does the property meet the tenant’s typical preferences that will allow it to be successful?

- The tenant’s business model – are they likely to last?

- The details of the lease – are there rent bumps and escalations? How long is the term?

Looking at these factors helps lenders assess whether or not they want to give you a loan. In addition, you’ll need to qualify through your own financial situation with the following factors:

- Net worth of $1 million or more, OR annual income over $200,000 (over $300,000 if you are married and file taxes jointly)

- Able to provide down payment between 30% and 40% of the loan’s total value

- Acceptable credit score

Federally insured banks or credit unions will usually provide your best loan options. Federal interest rates for commercial mortgages are currently sitting between 5.55% and 6.88%. As long as you meet your lender’s financial requirements and have a high-quality property. you should be able to get financing for your 7 Brew NNN lease.

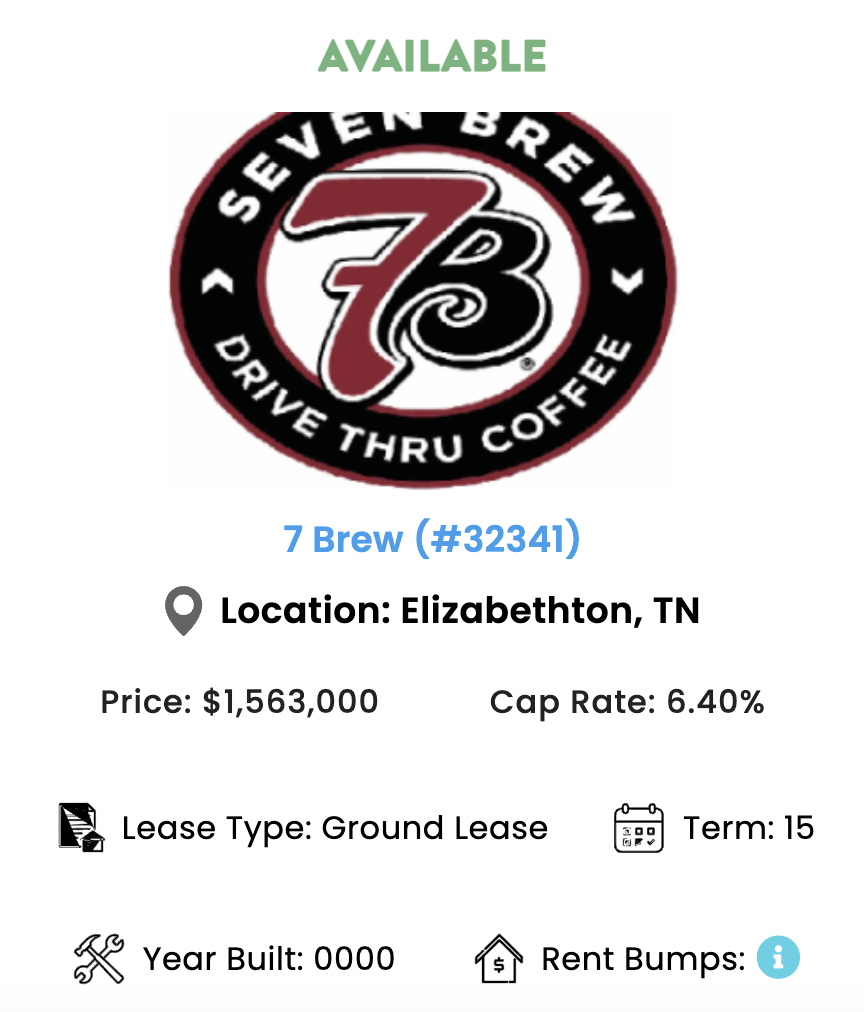

How to Evaluate a 7 Brew Net Lease

When evaluating a 7 Brew NNN for sale (or any triple net lease), we recommend looking at factors like property value, tenant strength, creditworthiness, and cap rate. As an example, let’s consider a 7 Brew NNN for sale in Tennessee…

Example 7 Brew NNN Lease

This 7 Brew location in Elizabethton, TN is listed for $1.5M with a cap rate of 6.40%. The average cap rate, or capitalization rate, for a 7 Brew NNN for sale is 6.45%. This figure looks at the profitability and return potential of a real estate investment.

Typically, cap rates of 5% to 10% are considered good – so this 6.4% cap rate is on the higher end of acceptable, meaning investors have a chance to take on a slightly higher risk for a slightly higher return.

Loan Details (Assuming 35% Down Payment & 6% Interest Rate)

- Down Payment: $525,000 (35% of purchase price)

- Loan Amount: $975,000

- Interest Rate: 6.00%

- Long Term: 10 years, amortized over 25 years

- Annual Loan Payments: ~$76,500

Investment Summary:

With an annual NOI of $96,000 and loan payments of approximately $76,500/year, the investor would generate a net cash flow of $19,500 per year after debt service. This lease structure allows the investor to own a fully passive income property, as the tenant is responsible for all property expenses. Over time, the investor builds equity while earning steady returns, making this 7 Brew lease a solid long-term investment.

Like many NNN tenants (such as Chick-fil-A or McDonald’s), 7 Brew is a well-known company with a strong balance sheet and a widespread fan base. You can count on this tenant to pay rent on time, making commercial real estate investment easy for you.

What Makes 7 Brew an Attractive NNN Tenant?

7 Brew has a dedicated fan base and widespread popularity, with locations everywhere from Texas to Wisconsin. Its strong growth rates and ongoing franchise development make it stand out as a company that is built to last, meaning you’ll be able to count on revenue from your commercial property for years to come.

If you are looking for a strong commercial real estate tenant in the QSR and fast food space, a 7 Brew NNN for sale is an excellent investment for the savvy property owner.

| ID | Status | Tenant | Price | City | State | Cap Rate | Years | Lease Type | Year Built | Details |

|---|